The four main pillars of financial literacy are:

1. Budgeting and Money Management: This pillar focuses on creating and maintaining a budget, tracking income and expenses, and effectively managing money. It involves understanding cash flow, setting financial goals, and making informed decisions about spending and saving.

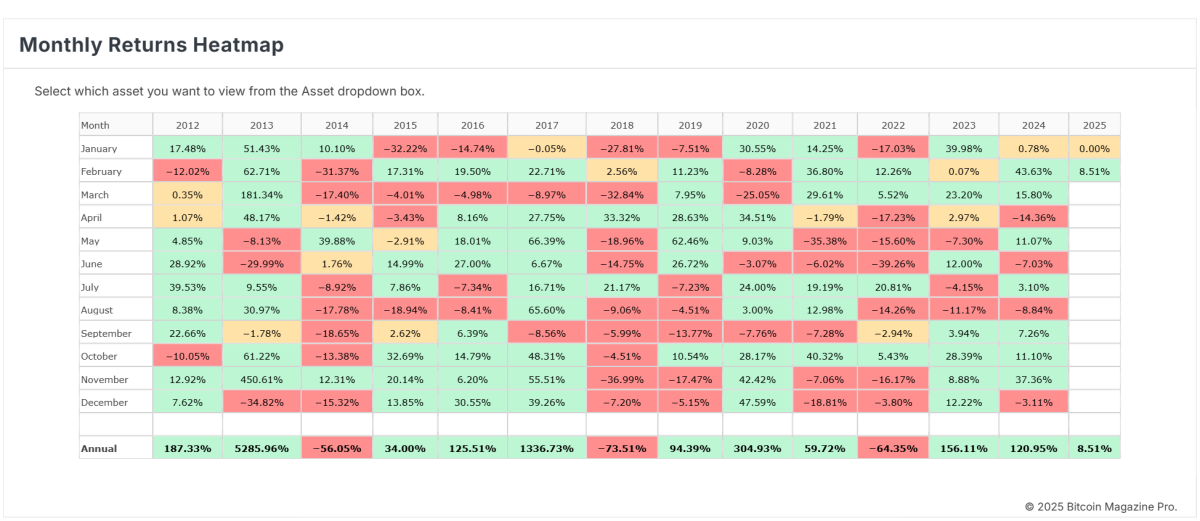

2. Saving and Investing: This pillar emphasizes the importance of saving money and making wise investment choices. It involves understanding different savings and investment options, such as savings accounts, stocks, bonds, mutual funds, and retirement accounts. It also includes knowledge of risk and return, diversification, and long-term financial planning.

3. Debt Management: This pillar focuses on understanding and managing debt effectively. It involves knowledge of different types of debt, such as credit cards, loans, and mortgages, and strategies for debt repayment. It also includes understanding interest rates, credit scores, and the impact of debt on overall financial health.

4. Financial Planning and Goal Setting: This pillar involves setting short-term and long-term financial goals and creating a plan to achieve them. It includes understanding the importance of emergency funds, retirement planning, insurance coverage, and estate planning. Financial planning also involves regularly reviewing and adjusting financial goals and strategies based on changing circumstances.

By developing knowledge and skills in these four areas, individuals can enhance their financial literacy and make informed decisions to improve their financial well-being.