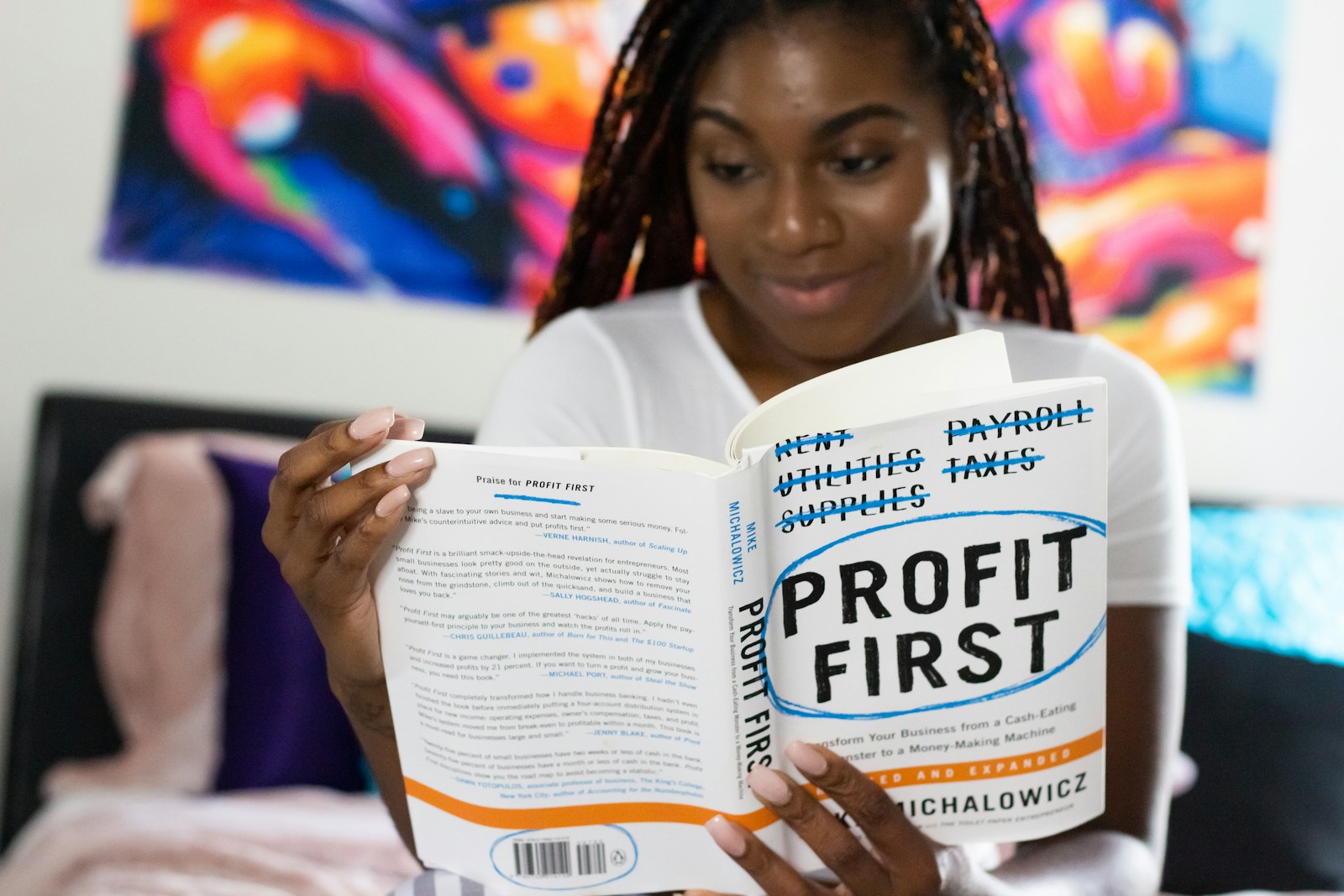

How to Master Your Finance: 7 Essential Books to Transform Your Financial Future

Managing personal finances is one of the most critical life skills you can acquire. Whether you’re working to pay off debt, build wealth, or simply understand the financial world around you, mastering your personal finance is key to achieving your long-term goals. Today, we’ll dive into seven must-read books that provide the knowledge, strategies, and…