Beyond Budgeting: A Comprehensive Guide to Embracing Financial Literacy

In today’s dynamic economic landscape, financial literacy has emerged as a fundamental skill essential for individuals, families, and businesses alike. Beyond the conventional approach of budgeting lies a broader concept: embracing financial literacy. This comprehensive guide delves into the significance of financial literacy, explores the limitations of traditional budgeting methods, and provides actionable insights to navigate toward financial empowerment.

Understanding Financial Literacy:

Financial literacy encompasses the knowledge and skills necessary to make informed and effective decisions regarding money management, investments, debt, and wealth building. It involves understanding concepts such as budgeting, saving, investing, and retirement planning, among others. A financially literate individual possesses the ability to evaluate financial options critically, mitigate risks, and capitalize on opportunities.

The Limitations of Traditional Budgeting:

Traditional budgeting typically involves setting rigid spending limits for various expense categories based on income. While it provides a structured approach to financial management, it often fails to adapt to changing circumstances and priorities. Moreover, it may foster a scarcity mindset, focusing solely on cutting expenses rather than exploring avenues for wealth creation.

Embracing a Holistic Approach:

Beyond budgeting lies a holistic approach to financial management that emphasizes flexibility, empowerment, and long-term sustainability. This approach involves:

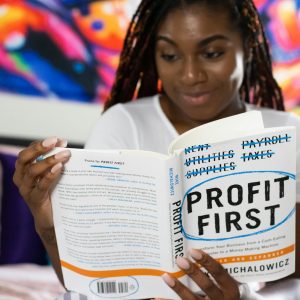

1. Financial Education:

Investing in financial education is paramount to enhancing financial literacy. Individuals can leverage various resources, such as books, online courses, seminars, and workshops, to deepen their understanding of personal finance principles.

2. Goal Setting:

Setting clear financial goals provides direction and motivation. Whether it’s saving for retirement, buying a home, or starting a business, defining objectives helps prioritize spending and investment decisions.

3. Creating a Spending Plan:

Rather than adhering to rigid budgets, adopting a spending plan allows for greater flexibility while ensuring responsible financial behavior. It involves allocating funds towards essential expenses, savings, investments, and discretionary spending based on individual priorities and values.

4. Building Emergency Funds:

Establishing an emergency fund is crucial to weathering unexpected financial setbacks such as job loss, medical emergencies, or major home repairs. Aim to set aside three to six months’ worth of living expenses in a liquid, easily accessible account.

5. Diversifying Income Streams:

Relying solely on a single source of income can leave individuals vulnerable to economic volatility. Diversifying income streams through side hustles, freelance work, rental properties, or investments can enhance financial stability and resilience.

6. Embracing Technology:

Advancements in financial technology (fintech) have democratized access to financial services and tools. Utilize budgeting apps, investment platforms, and robo-advisors to streamline financial management processes and gain insights into spending habits.

7. Investing wisely:

Investing is a key component of wealth accumulation. Educate yourself on different investment vehicles,F such as stocks, bonds, mutual funds, real estate, and cryptocurrencies. Diversify your investment portfolio based on risk tolerance, time horizon, and financial goals.

8. Continuous Evaluation and Adjustment:

Financial management is an iterative process that requires regular review and adjustment. Monitor your financial progress, reassess goals, and make necessary changes to your spending, saving, and investment strategies as circumstances evolve.

Conclusion:

Embracing financial literacy transcends traditional budgeting methods, offering a holistic approach to financial empowerment and wealth creation. By investing in education, setting clear goals, adopting flexible spending plans, diversifying income streams, leveraging technology, and making informed investment decisions, individuals can navigate the complexities of personal finance with confidence and resilience. Start your journey towards financial literacy today and unlock a world of possibilities for a secure and prosperous future.