In today’s fast-paced world, saving money might seem like a daunting task. However, with the right strategies and a bit of discipline, anyone can save $10K effortlessly. Here, we present five comprehensive tips that will help you achieve this financial milestone.

1. Automate Your Savings

One of the most effective ways to save money effortlessly is to automate your savings. By setting up automatic transfers from your checking account to a savings account, you ensure that a portion of your income is saved without you having to think about it.

How to Automate Your Savings

- Choose the Right Savings Account: Opt for a high-yield savings account to maximize your interest earnings.

- Set Up Automatic Transfers: Most banks allow you to set up automatic transfers. Decide on a fixed amount to be transferred monthly, bi-weekly, or weekly.

- Increase Transfers Gradually: As you become more comfortable with your budget, try increasing the transfer amount.

2. Create a Budget and Stick to It

Creating a budget is a fundamental step in managing your finances. It helps you understand where your money is going and identify areas where you can cut back.

Steps to Create an Effective Budget

- Track Your Spending: Use a budgeting app or a simple spreadsheet to track all your expenses for a month.

- Categorize Expenses: Divide your expenses into categories such as housing, food, transportation, and entertainment.

- Set Spending Limits: Based on your income and financial goals, set realistic spending limits for each category.

- Review and Adjust: Regularly review your budget and make adjustments as needed.

3. Cut Down on Unnecessary Expenses

Identifying and eliminating unnecessary expenses can significantly boost your savings. This doesn’t mean depriving yourself of all luxuries, but rather being mindful of your spending habits.

Ways to Cut Down on Unnecessary Expenses

- Cancel Subscriptions: Review your subscriptions and cancel those you rarely use.

- Eat Out Less: Preparing meals at home can save a considerable amount of money.

- Shop Smart: Look for discounts, use coupons, and consider buying generic brands.

4. Take Advantage of Cashback and Rewards Programs

Utilizing cashback and rewards programs can be an excellent way to save money on your regular purchases. These programs offer you a percentage of your spending back, either as cash or points.

Maximizing Cashback and Rewards

- Choose the Right Credit Card: Select a credit card that offers the best cashback or rewards for the categories you spend the most in.

- Join Loyalty Programs: Many retailers offer loyalty programs that provide discounts and rewards.

- Use Apps and Websites: Apps like Rakuten and Honey can help you find cashback deals and discounts.

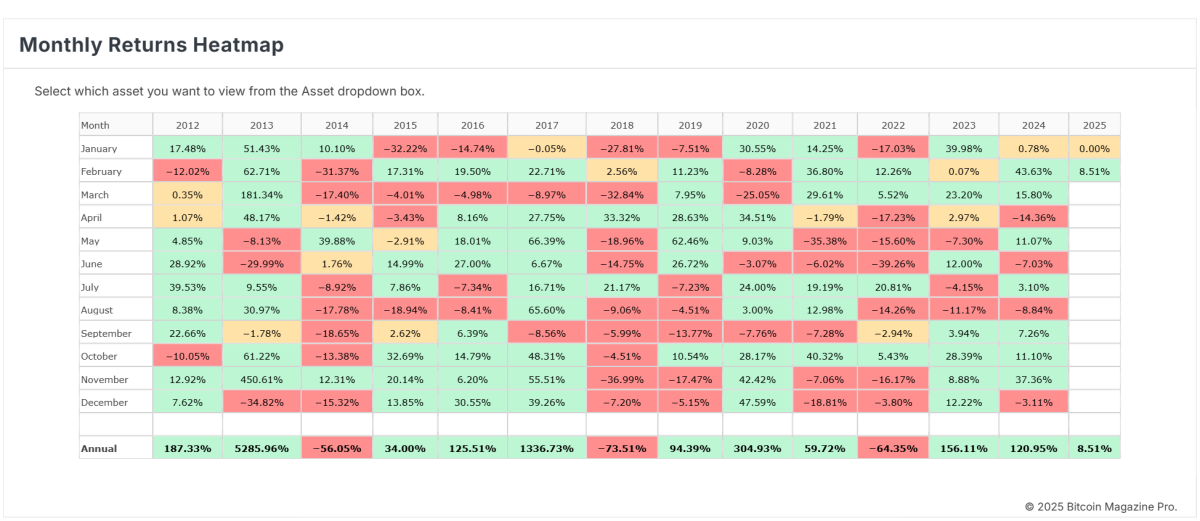

5. Invest Wisely

While saving money is crucial, investing is equally important. Wise investments can help your savings grow significantly over time.

Investment Strategies

- Start with Low-Risk Investments: Consider options like savings bonds, certificates of deposit (CDs), or high-yield savings accounts.

- Diversify Your Portfolio: Spread your investments across different asset classes to minimize risk.

- Consult a Financial Advisor: If you’re unsure where to start, a financial advisor can provide valuable guidance.

Conclusion

Saving $10K might seem challenging, but with these five tips, it’s entirely achievable. Automating your savings, creating and sticking to a budget, cutting unnecessary expenses, utilizing cashback and rewards programs, and investing wisely are all strategies that can help you reach your financial goals effortlessly.