Views: 1

1. Introduction to Passive Income

Definition of Passive Income

Passive income is money earned with minimal effort on your part. It’s like the gift that keeps on giving, allowing you to make money even when you’re not actively working.

Benefits of Generating Passive Income

The allure of passive income lies in its potential to provide financial freedom and security. It can offer you more time to pursue your passions or spend with loved ones, all while your money works for you.

2. Understanding the Concept of Making Money While You Sleep

How Passive Income Differs from Active Income

Active income requires you to trade your time and effort for money, whereas passive income allows you to earn without constant hands-on involvement. It’s like having a silent money-making machine.

The Power of Leveraging Time and Resources

With passive income, you can leverage your time and resources efficiently to create multiple streams of income. By setting up systems that work on autopilot, you can maximize your earning potential.

3. Exploring Various Passive Income Streams

Rental Income from Real Estate

Investing in rental properties can be a lucrative way to generate passive income. By owning and renting out real estate, you can earn a steady stream of cash flow each month.

Dividend Income from Investments

Dividend-paying stocks and other investment vehicles offer a passive income source through regular payouts. This can provide you with a consistent income stream while potentially growing your wealth.

Affiliate Marketing and Online Businesses

Through affiliate marketing or owning an online business, you can earn passive income by promoting products or services. With the right strategy, you can generate income through commissions or sales without the need for constant supervision.

4. Strategies for Building a Successful Passive Income Portfolio

Diversification of Income Streams

Diversifying your passive income streams can help spread risk and ensure a more stable financial foundation. By having multiple sources of income, you can protect yourself against potential downturns in any single market.

Setting Realistic Financial Goals

Setting clear and achievable financial goals is essential for building a successful passive income portfolio. By defining your objectives and creating a roadmap to reach them, you can stay motivated and track your progress towards financial independence.### 5. Tools and Resources to Automate Your Income Generation

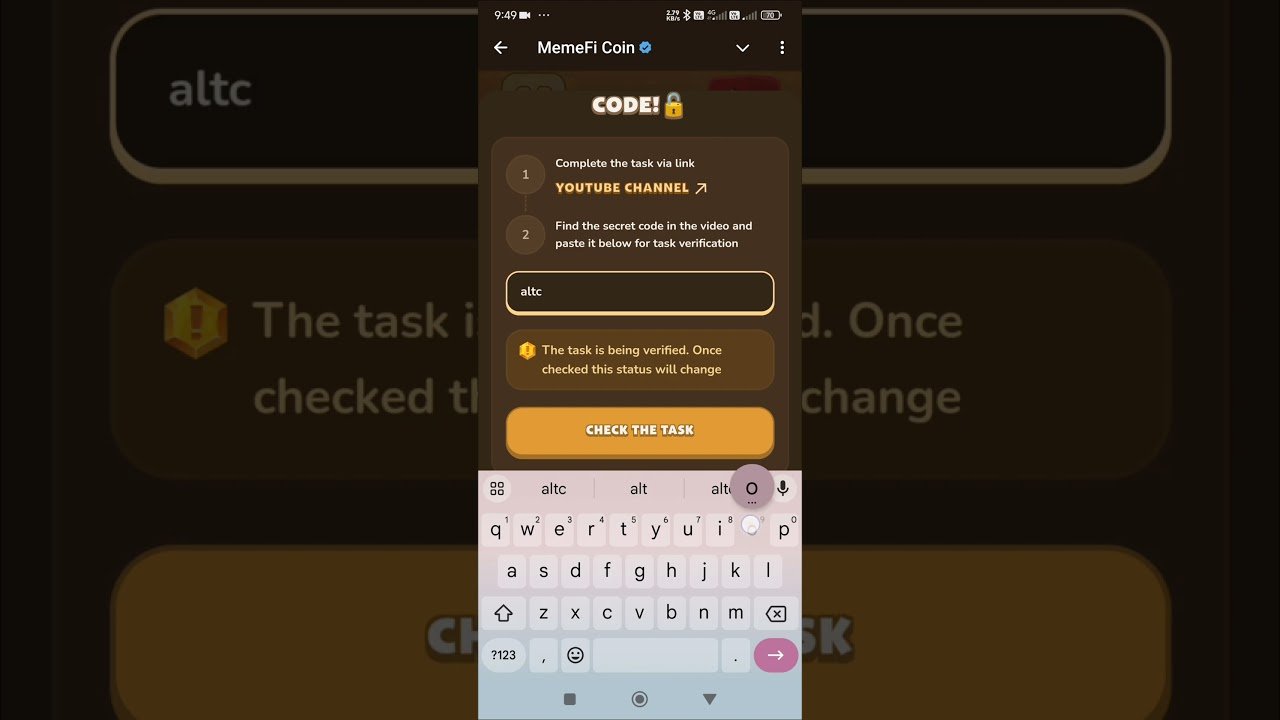

Using Automation Software and Apps

Want to make money in your sleep without having to lift a finger? Look no further than automation software and apps. These tools can help streamline your processes, from managing your finances to scheduling social media posts, so you can focus on dreaming big while the cash rolls in.

Outsourcing and Delegating Tasks

Don’t want to do it all yourself? You don’t have to! Outsourcing and delegating tasks can be a game-changer when it comes to generating passive income. Whether it’s hiring a virtual assistant to handle customer inquiries or a freelance writer to create content for your blog, freeing up your time can lead to more money in your pocket.

6. Overcoming Common Challenges in Generating Passive Income

Managing Risk and Uncertainty

Making money while you sleep sounds like a dream, but it’s not without its challenges. Managing risk and uncertainty is key to a successful passive income stream. Diversifying your investments, staying informed about market trends, and having a backup plan can help mitigate potential risks and keep your income flowing.

Staying Motivated and Persistent

It’s easy to get discouraged when your passive income efforts don’t yield immediate results. Staying motivated and persistent is crucial to long-term success. Remember, Rome wasn’t built in a day, and neither is a robust passive income portfolio. Stay focused, stay positive, and keep hustling even when the going gets tough.

7. Real-life Success Stories of Individuals Earning While They Sleep

Inspiring Examples of Passive Income Achievers

Curious about who’s making bank while catching some Z’s? Real-life success stories of individuals earning passive income can inspire you to turn your own dreams into reality. From affiliate marketing gurus to savvy real estate investors, there’s no shortage of role models to learn from.

Lessons Learned from Successful Passive Income Ventures

What can we glean from those who have cracked the code on generating passive income? Lessons learned from successful ventures can provide valuable insights into what works and what doesn’t. Whether it’s the importance of scalability, the power of residual income, or the value of continuous learning, there’s much to be gained from studying the strategies of passive income pioneers.In conclusion, understanding and implementing passive income strategies can pave the way for financial freedom and flexibility. By diversifying income streams, leveraging automation tools, and staying committed to your goals, you can unlock the potential to earn money while you sleep. Embrace the concept of passive income, and embark on a journey towards a more secure and prosperous financial future.

Frequently Asked Questions