Views: 323

10 Common Reasons the IRS Will Audit You

Navigating the complex terrain of tax filing can be daunting, and the prospect of an IRS audit adds another layer of anxiety. The Internal Revenue Service (IRS) audits a small percentage of tax returns annually, but understanding the triggers can help you steer clear of unwanted scrutiny. This article delves into the ten most common reasons the IRS might audit you and offers practical advice to mitigate these risks.

1. High Income

One of the primary triggers for an IRS audit is having a high income. The IRS is more likely to scrutinize returns from individuals earning significantly more than the average taxpayer. While earning a high income isn’t a red flag in itself, it does increase the likelihood of an audit.

Why It Triggers Audits

High-income taxpayers often have more complex financial situations, which can include multiple streams of income, large deductions, and potential discrepancies. The IRS targets high-income earners because any errors or omissions can lead to substantial revenue recovery.

How to Mitigate the Risk

Ensure thorough documentation and meticulous record-keeping. Hiring a reputable tax professional can help navigate complex tax laws and ensure your return is accurate.

2. Mathematical Errors

Simple mathematical errors on your tax return can trigger an audit. These errors can range from basic addition and subtraction mistakes to more complex calculation errors.

Why It Triggers Audits

Mathematical errors can signal to the IRS that there may be other inaccuracies in your return. Even minor mistakes can lead to adjustments in your tax liability, prompting further review.

How to Mitigate the Risk

Double-check all calculations and consider using tax software, which can reduce the likelihood of errors. Professional tax preparers can also ensure accuracy.

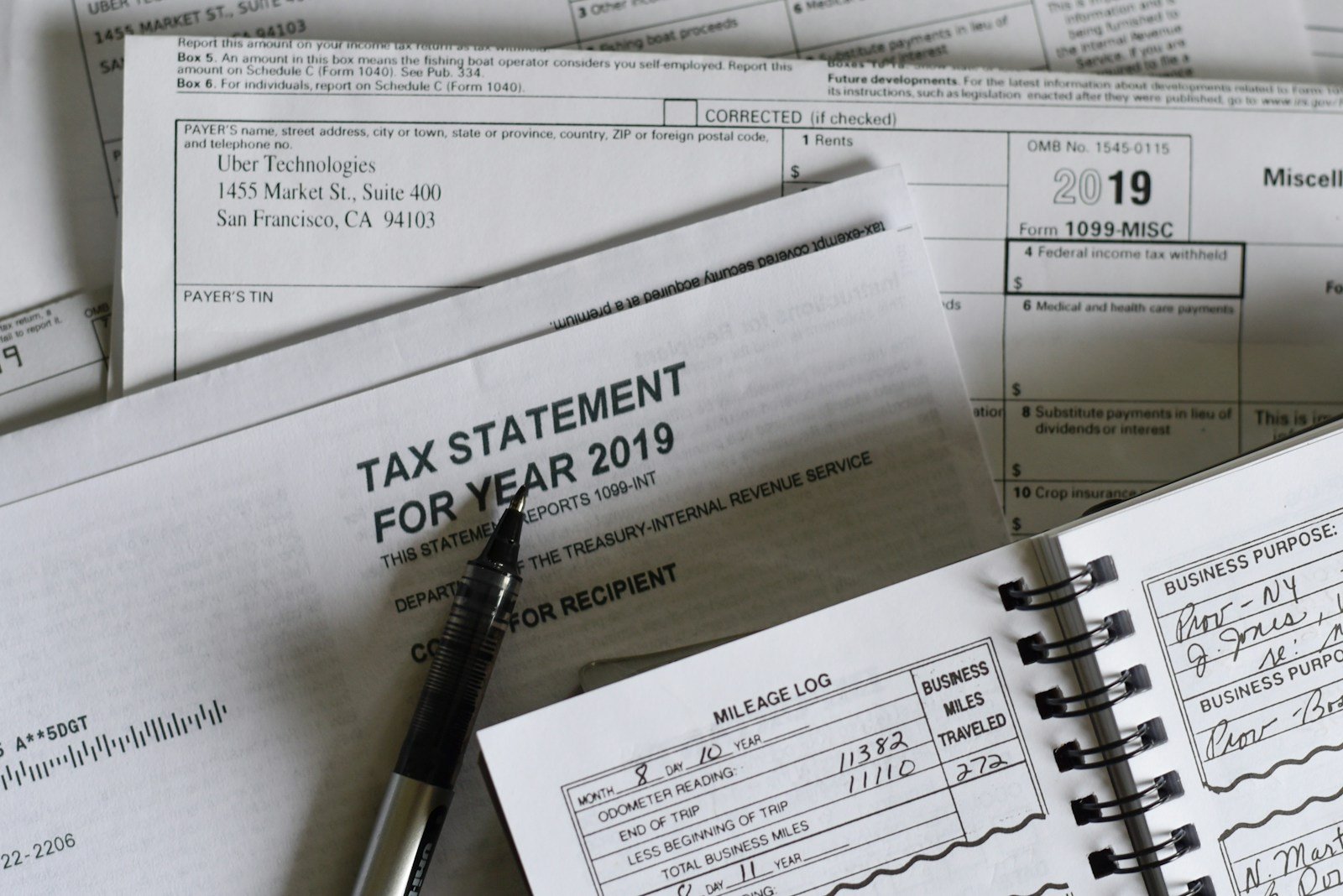

3. Unreported Income

Failing to report all sources of income is a significant red flag for the IRS. This includes wages, dividends, interest, rental income, and other miscellaneous income.

Why It Triggers Audits

The IRS receives copies of tax documents such as W-2s and 1099s from employers and financial institutions. If the income reported on your return doesn’t match these documents, it can lead to an audit.

How to Mitigate the Risk

Report all income accurately and keep thorough records of all financial transactions. Cross-check the income reported on your tax documents with your return to ensure consistency.

4. Excessive Deductions

Claiming excessive deductions, especially compared to your income level, can raise a red flag. This is particularly true for deductions related to business expenses, charitable contributions, and home office use.

Why It Triggers Audits

The IRS has benchmarks for average deduction amounts based on income levels. Deductions that significantly exceed these averages can trigger an audit.

How to Mitigate the Risk

Only claim deductions you’re entitled to and ensure you have proper documentation. For business expenses, keep detailed receipts and records. For charitable contributions, ensure you have written acknowledgments from the organizations.

5. Discrepancies Between State and Federal Returns

Inconsistencies between your state and federal tax returns can trigger an audit. The IRS and state tax authorities share information, and discrepancies can prompt a closer look.

Why It Triggers Audits

Discrepancies suggest that there may be errors or intentional misreporting. The IRS may compare returns to identify inconsistencies that could indicate fraud or mistakes.

How to Mitigate the Risk

Ensure consistency across all tax filings. If you amend one return, ensure you amend the other. Using the same tax preparer for both state and federal returns can help maintain consistency.

6. Claiming Dependents

Errors related to claiming dependents can attract IRS scrutiny. This includes claiming too many dependents, incorrect Social Security numbers, or not meeting the criteria for dependency.

Why It Triggers Audits

The IRS is vigilant about ensuring that dependent claims are accurate, as dependents can significantly reduce taxable income through exemptions and credits.

How to Mitigate the Risk

Verify that you meet all the criteria for claiming a dependent and ensure that all information, such as Social Security numbers, is accurate. Keep records to prove your dependent claims.

7. Large Charitable Donations

While charitable donations are commendable, claiming large contributions compared to your income can trigger an audit. This is especially true if the donations are disproportionate.

Why It Triggers Audits

The IRS looks for consistency between income levels and donation amounts. Excessive donations may be scrutinized to ensure they are legitimate and properly documented.

How to Mitigate the Risk

Maintain detailed records of all charitable contributions, including receipts and written acknowledgments. If you donate items, ensure you have appraisals for significant value items.

8. Self-Employment Income

Self-employed individuals face higher scrutiny due to the potential for underreporting income and overreporting deductions. The IRS is particularly attentive to small businesses and sole proprietors.

Why It Triggers Audits

Self-employment income can be more difficult to track, and the potential for discrepancies is higher. The IRS aims to ensure all income is reported and that deductions are legitimate.

How to Mitigate the Risk

Keep meticulous records of all income and expenses. Consider hiring a professional accountant to ensure accuracy and compliance with tax laws.

9. Foreign Accounts and Income

Having foreign accounts or earning income abroad can increase the likelihood of an audit. The IRS requires disclosure of foreign financial assets through the Foreign Account Tax Compliance Act (FATCA) and other reporting requirements.

Why It Triggers Audits

The IRS focuses on foreign accounts to prevent tax evasion. Failure to report foreign assets or income can lead to significant penalties and increased scrutiny.

How to Mitigate the Risk

Ensure full compliance with all reporting requirements for foreign accounts and income. Consult with a tax professional who specializes in international tax law.

10. High Itemized Deductions

Taxpayers who claim high itemized deductions compared to the standard deduction can attract IRS attention. This includes deductions for medical expenses, mortgage interest, and property taxes.

Why It Triggers Audits

Itemized deductions that are significantly higher than average can signal potential overreporting or misreporting. The IRS uses statistical models to identify outliers.

How to Mitigate the Risk

Only itemize deductions if they exceed the standard deduction and ensure you have detailed documentation. Consult with a tax advisor to determine the most beneficial and compliant deduction strategy.

Conclusion

While the prospect of an IRS audit can be intimidating, understanding the common triggers can help you avoid unnecessary scrutiny. By maintaining accurate records, ensuring consistency across all tax documents, and consulting with tax professionals when necessary, you can significantly reduce the risk of an audit. Remember, transparency and accuracy are key to staying in the good graces of the IRS. Stay informed, stay compliant, and you can navigate tax season with confidence.